Post-Election Tax Implications & Potential Changes

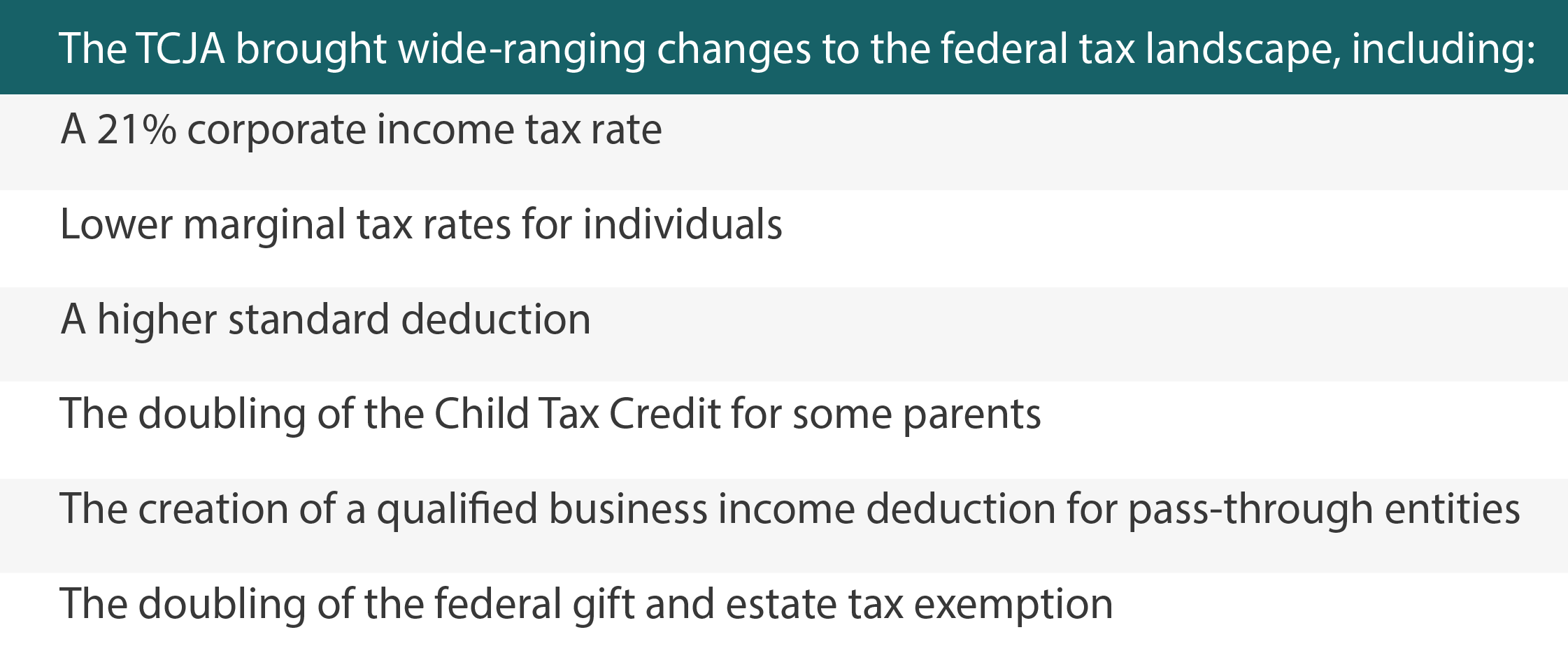

President-Elect Donald Trump is set to return to the White House in 2025, a year already primed for major federal tax developments. With a projected unified GOP Congress—Republicans having regained the Senate and maintained control of the House—early legislative wins seem likely. Chief among them is the anticipated extension and expansion of Trump’s hallmark 2017 tax reform, the Tax Cuts and Jobs Act (TCJA).

During his campaign, Trump hinted at several initiatives that could be included in a TCJA update or new legislation. Here’s a closer look at potential changes for businesses and individual taxpayers in 2025 and beyond.

The TCJA’s Ticking Clock

Although most of the corporate provisions are permanent, many TCJA provisions regarding individual taxes, as well as the doubled gift and estate tax exemption, are scheduled to expire at the end of 2025. Trump has endorsed extending those tax breaks.

Additional Proposals Affecting Business Taxes

During the campaign, Trump proposed several tax changes that businesses would welcome. For example, he would further reduce the corporate tax rate, to 15%, for companies that make their products in the United States.

He also has called for two changes that may have bipartisan support. Trump would allow companies to immediately expense their research and experimentation costs, rather than capitalize and amortize them, and return to 100% first-year bonus depreciation for qualifying capital investments. Under the TCJA, the allowable first-year bonus deduction is 60% for 2024, and for 2025 it’s slated to be 40%. Without congressional action, it will drop to zero in 2027.

In addition, Trump has spoken of doubling the ceiling on the Sec. 179 expensing deduction for small businesses’ qualifying investments in equipment. The TCJA permanently capped the deduction at $1 million, adjusted annually for inflation ($1.22 million for 2024). The deduction is subject to a phaseout when the cost of qualifying purchases exceeds $2.5 million ($3.05 million for 2024, adjusted for inflation).

Additional Proposals Affecting Individual Taxes

One TCJA provision that Trump has expressed second thoughts about is the $10,000 cap on the state and local tax deduction. The cap, which hits taxpayers hardest in states with high property taxes, is set to expire after 2025. Congress could just let it expire or even terminate it early, depending on how quickly lawmakers can move tax legislation.

A TCJA expansion or additional legislation could incorporate Trump’s promises to eliminate taxes on tips for restaurant and hospitality workers. (It’s unclear if he was referring only to federal income taxes or also payroll taxes.) Without limitations, such a provision could benefit individuals who restructure their compensation to reduce their tax bills by, for example, classifying bonuses as tips.

Trump has also proposed excluding overtime pay and Social Security payments from taxation. In addition, the president-elect has proposed a new deduction for interest on car loans for vehicles manufactured in the United States and a reduction in taxes for Americans living abroad.

Trump also said he’d consider making police officers, firefighters, active duty military members and veterans exempt from paying federal taxes. And in a social media post, he wrote that if he won, hurricane victims could deduct the cost of a home generator, retroactive to September 1, 2024.

Potential Tariffs

Trump has repeatedly pledged to impose a baseline tariff of 10% on imported goods, with a 60% tariff on imports from China and possibly a higher tariff on imports from Mexico. It is unknown whether exporting countries or consumers within the U.S. would ultimately bear the cost of these increased tariffs.

Rollback of the IRA

The GOP has had the Inflation Reduction Act (IRA) in its crosshairs since the law first passed with zero Republican votes. Trump has vowed to cut unspent funds allocated for the IRA’s tax incentives for clean energy projects.

But a significant number of clean energy manufacturing projects that rely on the credits are planned or underway in Republican districts and states, which could give the GOP pause. A group of Republican legislators signed a letter to Speaker of the House Mike Johnson this past August, opposing a full repeal of the IRA. Trump could instead advocate for keeping some of the tax credits or restricting them, for example, through tighter eligibility requirements.

Connect With an Advisor for Updates

While it’s risky to count on campaign promises becoming reality, one thing is clear: 2025 will be a pivotal year for tax legislation. Beyond the key issues already mentioned, the debate will include “tax extenders” for various temporary business and individual tax provisions. Stay tuned as we keep you updated on changes that could impact your tax liability.